Illegals and Anchor Babies Cost to Tax Payers

The Fiscal Brunt of Illegal Immigration on United states Taxpayers

Report by Matt O'Brien and Spencer Raley | September 27, 2017 | View the Full Study (PDF)

Fundamental Highlights

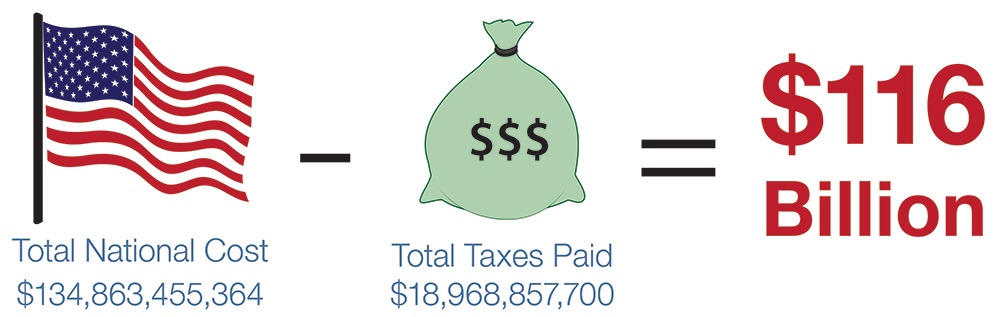

- In 2017, the total cost of illegal immigration for the United States – at the federal, state, and local levels – was approximately $116 billion.

- Fair arrived at this number by subtracting the tax revenue paid by illegal aliens – nigh $19 billion – from the total economic impact of illegal migration, $134.9 billion.

- In 2013, the estimated total cost of illegal migration was approximately $113 billion. So, in under iv years, the toll has risen nearly $3 billion.

- Evidence shows that the tax payments made by illegal aliens neglect to cover the costs of the many services they swallow.

- A large percentage of illegal aliens who work in the hole-and-corner economy often avoid paying any income tax at all.

- Many illegal aliens really receive a net cash profit through refundable revenue enhancement credit programs.

Introduction

A continually growing population of illegal aliens, forth with the federal government's ineffective efforts to secure our borders, present pregnant national security and public safety threats to the United States. They too take a severely negative impact on the nation'south taxpayers at the local, state, and national levels. Illegal immigration costs Americans billions of dollars each year. Illegal aliens are net consumers of taxpayer-funded services and the limited taxes paid by some segments of the illegal alien population are, in no way, meaning enough to kickoff the growing financial burdens imposed on U.S. taxpayers by massive numbers of uninvited guests. This study examines the fiscal impact of illegal aliens as reflected in both federal and land budgets.

The Number of Illegal Immigrants in the United states

Estimating the fiscal brunt of illegal clearing on the U.S. taxpayer depends on the size and characteristics of the illegal alien population. Fair defines "illegal alien" equally anyone who entered the United States without potency and anyone who unlawfully remains once his/her authorization has expired. Unfortunately, the U.Due south. authorities has no central database containing information on the citizenship status of everyone lawfully nowadays in the United States. The overall problem of estimating the illegal conflicting population is further complicated by the fact that the bulk of available sources on clearing status rely on self-reported information. Given that illegal aliens have a motive to lie almost their immigration status, in gild to avoid discovery, the accuracy of these statistics is dubious, at best. All of the foregoing problems brand information technology very difficult to assess the electric current illegal conflicting population of the United States.

However, Fair now estimates that there are approximately 12.v million illegal alien residents. This number uses FAIR's previous estimates but adjusts for suspected changes in levels of unlawful migration, based on information available from the Department of Homeland Security, information available from other federal and country government agencies, and other enquiry studies completed past reliable think tanks, universities, and other research organizations.

The Cost of Illegal Immigration to the United States

At the federal, state, and local levels, taxpayers shell out approximately $134.9 billion to cover the costs incurred by the presence of more than than 12.five 1000000 illegal aliens, and about 4.2 million citizen children of illegal aliens. That amounts to a taxation brunt of approximately $eight,075 per illegal conflicting family member and a total of $115,894,597,664. The full cost of illegal immigration to U.S. taxpayers is both staggering and crippling. In 2013, FAIR estimated the total price to be approximately $113 billion. So, in under four years, the cost has risen nearly $3 billion. This is a agonizing and unsustainable tendency. The sections below volition suspension down and further explain these numbers at the federal, state, and local levels.

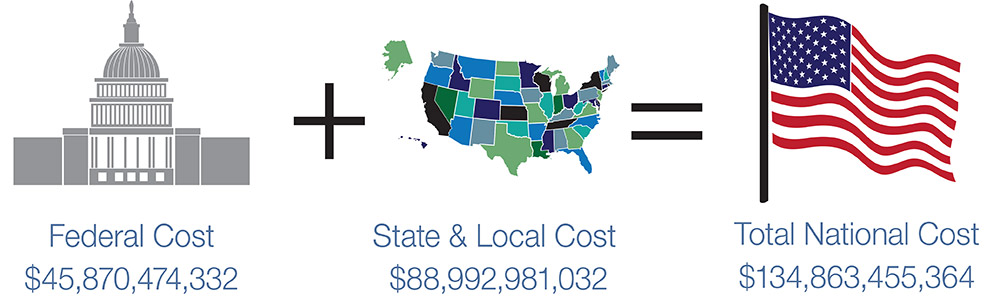

Total Governmental Expenditures on Illegal Aliens

Total Taxation Contributions by Illegal Aliens

Total Economic Impact of Illegal Clearing

Federal

The Federal regime spends a net amount of $45.eight billion on illegal aliens and their U.S.-built-in children. This amount includes expenditures for public teaching, medical care, justice enforcement initiatives, welfare programs and other miscellaneous costs. It also factors in the meager corporeality illegal aliens pay to the federal authorities in income, social security, Medicare and excise taxes.

Federal Spending

The approximately $46 billion in federal expenditures attributable to illegal aliens is staggering. Assuming an illegal alien population of approximately 12.5 million illegal aliens and 4.ii one thousand thousand U.Due south.-born children of illegal aliens, that amounts to roughly $two,746 per illegal conflicting, per year. For the sake of comparing, the average American college student receives simply $four,800 in federal educatee loans each year.

FAIR maintains that every concerned American citizen should exist asking our government why, in a fourth dimension of increasing costs and shrinking resource, is it spending such big amounts of money on individuals who have no right, nor authorisation, to exist in the United States? This is an specially important question in view of the fact that the illegal alien beneficiaries of American taxpayer largess starting time very little of the enormous costs of their presence by the payment of taxes. Meanwhile, average Americans pay approximately thirty% of their income in taxes.

Total Federal Educational Expenditures:

| Principal and Secondary Education | $943,200,000 |

| Limited English Proficiency (LEP) – Title Iii | $541,694,040 |

| Migrant schooling (Championship I C) | $206,140,000 |

| Full | $ane,691,034,040 |

Total Federal Medical Expenditures

| Uncompensated Hospital Expenditure | $8,200,000,000 |

| Medicaid Births | $1,242,990,372 |

| Medicaid Fraud | $3,458,475,000 |

| Medicaid for U.Due south.-born Kids of Illegal Aliens | $4,234,129,200 |

| Total | $17,135,594,572 |

Total Federal Justice Enforcement Expenditures

| Federal Incarceration | $1,240,000,000 |

| Enforcement and Removals | $three,218,000,000 |

| Customs and Border Protection | $5,968,729,360 |

| Other Ice Operations | $i,126,840,000 |

| State Criminal Alien Assistance Program (SCAAP) | $210,000,000 |

| Executive Part for Clearing Review (EOIR) | $168,120,000 |

| Alien Minors | $1,200,000,000 |

| Byrne grants | $16,920,000 |

| Total | $xiii,148,609,360 |

Full Federal Welfare Programs

| Meals in Schools | $i,003,000,000 |

| Supplemental Diet Help Program | $ane,963,416,000 |

| Women Infants and Children | $1,097,820,360 |

| Temporary Assist for Needy Families | $ane,785,000,000 |

| Total | $5,849,236,360 |

Full Federal Expenditures

| Educational Expenditures | $1,691,034,040 |

| Medical Expenditures | $17,135,594,572 |

| Law Enforcement | $13,148,609,360 |

| Welfare Programs | $5,849,236,360 |

| General Federal Expenditures | $viii,046,000,000 |

| Full | $45,870,474,332 |

Federal Taxes

Taxes collected from illegal aliens offset fiscal outlays and, therefore must be included in any examination of the price of illegal immigration. Withal, illegal conflicting apologists oftentimes cite the allegedly large tax payments made past illegal aliens as a justification for their unlawful presence, and as a basis for offering them permanent legal status through a new amnesty, similar to the one enacted in 1986. That argument is zip more than a scarlet herring.

FAIR believes that most studies grossly overestimate both the taxes actually nerveless from illegal aliens and, more chiefly, the corporeality of taxes actually paid by illegal aliens (i.east., the amount of money nerveless from illegal aliens and actually kept by the federal government). This belief is based on a number of factors: Since the 1990's, the Us has focused on acumen and removing criminal aliens. The majority of illegal aliens seeking employment in the Us have lived in an environment where they take little fearfulness of deportation, even if discovered. This has created an surroundings where most illegal aliens are both able and willing to file taxation returns. Because the vast majority of illegal aliens hold low-paying jobs, those who are subject to wage deductions actually wind upward receiving a complete refund of all taxes paid, plus cyberspace payments made on the footing of taxation credits.

Every bit a result, illegal aliens really turn a profit from filing a tax return and, therefore, have a strong interest in doing so.

Federal Receipts from Illegal Aliens

| Income Taxes | $3,299,957,700 |

| Social Security and Medicare Taxes | $xviii,490,000,000 |

| Excise taxes | $401,140,000 |

| Total Receipts | $22,191,097,700 |

Credits Given to Illegal Aliens

| ACTC | $iv,200,000,000 |

| EITC | $2,543,200,000 |

| Total Credits | $vi,743,200,000 |

Internet Federal Receipts from Illegal Aliens

| Full Receipts | $22,191,097,700 |

| Full Credits | -$six,743,200,000 |

| Cyberspace Federal Receipts from Illegal Aliens | $ 15,447,897,700 |

Total Federal Economic Affect of Illegal Clearing

Cyberspace Federal Impact of Illegal Aliens

| Total Federal Outlays | $45,870,474,332 |

| Internet Federal Receipts | $fifteen,447,897,700 |

| Net Fiscal Impact | $30,422,576,632 |

State and Local

Fifty-fifty though the costs of illegal immigration borne past taxpayers at the federal level are staggering, they just pale in comparison to the fiscal burden shouldered past taxpayers at the state level. About regime taxes and fees remitted to government by Americans are paid in forms other than income taxes submitted to the IRS on Apr 15th. There are metropolis and state income taxes, fuel surcharges, sales and property taxes, etc…. States and localities likewise bear the main brunt for costs associated with public education, city and county infrastructure, and local courts and jails.

A further complication is the fact that, while barred from many federal benefits, state laws allow illegal aliens to access many state-funded social welfare programs. Considering so picayune data is collected on the immigration status of individuals collecting benefits, information technology is difficult to decide the rate at which illegal aliens use welfare programs. However, based on the average income of illegal alien households, information technology appears they utilize these programs at a rate higher than lawfully nowadays aliens or citizens.

Land and Local Spending

The combined total of state and local government general expenditures on illegal aliens is $xviii,571,428,571 billion. The services referenced in this section are supported directly past the payment of urban center and state taxes and related fees. At the state level, examples of full general expenditures would be the costs of general governance, burn down departments, garbage collection, street cleaning and maintenance, etc. The state, canton or municipality — or even a special taxing district in some situations — may provide some of these services. In nearly cases, localities offer more services than the state. By FAIR's estimate, in that location is approximately a 65 percent to 35 percent cost share between local and state governments.

The estimate of general expenditure services received by illegal alien households, beyond the specific outlays mentioned in the sections above, excludes upper-case letter expenditures and debt servicing. The adding for each state is based on the state's annual operating upkeep, reduced by the amount covered by the federal government. That expenditure is then reduced further based on the relative size of the estimated population of illegal aliens and their U.S.-born minor children. As noted in our population approximate, this means states like California, Texas, Florida, New York, etc., with larger illegal conflicting cohorts, will bear larger shares of these costs.

Total Land Educational Expenditures

| Public Schoolhouse Expenditures | $43,396,433,856 |

| Postal service-secondary tuition help | $i,040,000,000 |

| Total Educational Expenditures | $44,436,433,856 |

Total State Medical Expenditures

| Medicaid births | $730,010,218 |

| Uncompensated Medical Expense | $6,930,000,000 |

| Improper Medicaid Payouts | $2,031,025,000 |

| Medicaid for Denizen Children of Illegal Alien | $2,486,710,800 |

| Total Medical Expenditures | $12,177,746,018 |

Total State Administration of Justice Expenditures

| Policing | $4,727,322,000 |

| Judicial | $2,227,368,973 |

| Corrections | $3,622,579,000 |

| Land Border | $490,780,000 |

| Total | $11,068,049,973 |

| SCAAP funds from Federal Government | -$189,000,000 |

| Net Justice Expenditures | 10,879,049,981 |

Total State Welfare Expenditures

| Child Care and Development Fund | $657,320,000 |

| Temporary Help to Needy Families | $321,000,000 |

| Meals in Schools | $1,950,000,000 |

| Total Welfare Expenditure | $2,928,322,607 |

Total State and Local Expenditures

| Total Education Expenditures | $44,436,433,856 |

| Total Medical Expenditures | $12,177,746,018 |

| Full Administration of Justice Costs | $10,879,049,981 |

| Full Welfare Expenditure | $two,928,322,607 |

| General Expenditures | $xviii,571,428,571 |

| Country and Local Full | $88,992,981,032 |

Land and Local Taxes Collected

Offsetting the financial costs of the illegal alien population are the taxes collected from them at the country and local level. Many proponents of illegal immigration argue that the taxes paid to united states of america render illegal aliens a net boon to state and local economies. However, this is a spurious statement. Evidence shows that the revenue enhancement payments made past illegal aliens fail to cover the costs of the many services they consume.

Illegal aliens are non typical taxpayers. Kickoff, as previously noted in this study, the large percentage of illegal aliens who work in the underground economy frequently avoid paying any income tax at all. (Many really receive a net cash profit through refundable tax credit programs.) 2nd, and as well previously noted, the average earnings of illegal alien households are considerably lower than both legal aliens and native-born workers.

Internet Country Taxes Collected

| Full Country Tax Receipts | $918,000,000 |

| Belongings Tax Receipts: | $1,049,760,000 |

| Income Tax Receipts: | $598,600,000 |

| Fuel/Transportation Sales Revenue enhancement Receipts: | $1,000,000,000 |

| Total Land Taxes Paid: | $3,566,360,000 |

| Earned Income Tax Credits | -$45,400,000 |

| Cyberspace State Tax Receipts | $3,520,960,000 |

Total State and Local Economic Bear upon of Illegal Immigration

| Total State and Local Expenditures | $88,992,981,032 |

| Total State and Local Tax Receipts | -$iii,520,960,000 |

| Internet Land and Local Financial Impact | $85,472,021,032 |

Combined Federal State Toll Tables

Total Expenditures

| Total Federal Expenditures | $45,870,474,332 |

| Total State and Local Expenditures | $88,992,981,032 |

| Full National Expenditures | $134,863,455,364 |

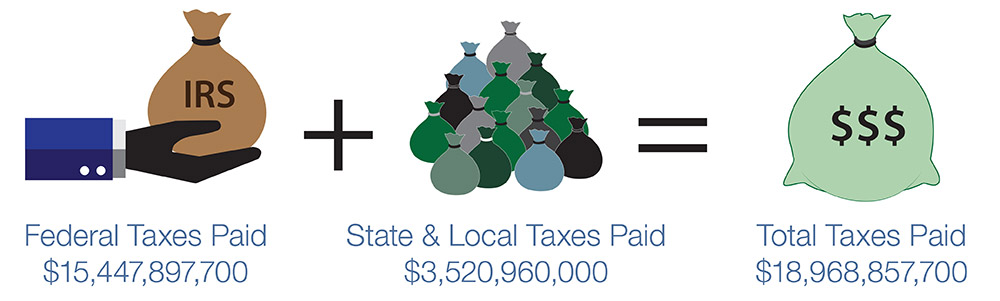

Total Tax Contributions

| Full Federal Taxes Paid | $fifteen,447,897,700 |

| Total State and Local Taxes Paid | $3,520,960,000 |

| Total Revenue enhancement Contributions | $18,968,857,700 |

Total Cost of Illegal Clearing

| Total National Expenditures | $134,863,455,364 |

| Minus Total Tax Contributions | $18,968,857,700 |

| Full Fiscal Price of Illegal Aliens on Taxpayers: | $115,894,597,664 |

Source: https://www.fairus.org/issue/publications-resources/fiscal-burden-illegal-immigration-united-states-taxpayers

0 Response to "Illegals and Anchor Babies Cost to Tax Payers"

Post a Comment